Leveraging SeerBit virtual account for bank transfer payments

Nigeria's payment landscape is rapidly evolving and one method is emerging as the clear frontrunner - bank transfer payments. A staggering 7 out of 10 transactions in the country are now conducted through bank transfers, highlighting the growing preference for this payment option. With over 80% of the Nigerian population having access to banking services and recent cash policies driving its adoption, bank transfers have become an integral part of the payment ecosystem.

In this article, we will explore the benefits of leveraging bank transfer payments and how businesses can harness its potential with SeerBit's Virtual Accounts.

Read: What is a virtual account and why you need it for your business

The power of bank transfers for customer convenience

Bank transfers have gained widespread acceptance in Nigeria due to their simplicity and familiarity among customers. With a large portion of the population having access to bank accounts, it is a payment method that is accessible to individuals from all walks of life. Whether it's a tech-savvy urban dweller or someone from a rural community, the ease of initiating bank transfers through mobile apps, USSD codes, or online banking platforms makes it a seamless option for everyone.

Importance of Customer Convenience in Enhancing Retention Rates

Streamlined payment process and reduced friction

One of the critical advantages of bank transfer payments is the streamlined payment process it offers. Customers can easily make payments without having to go through complex procedures, reducing the chances of cart abandonment and improving customer satisfaction. With just a few clicks, payment can be initiated and completed hassle-free.

Accessibility for customers without debit cards

Bank transfers cater to a wider range of customers, as it removes the requirement for credit or debit cards. Even if a customer doesn't have a debit card or doesn't own one, they can still make a purchase using a bank transfer at the time of checkout. By offering bank transfer payments, businesses can boost their sales and achieve their daily sales goals more effectively.

Trust and Security

Bank transfers instill a sense of trust and security in both customers and businesses, this is because payments must be initiated by the owner of the bank account, either from their mobile app, online banking platform or via USSD, ensuring the authenticity of transactions.

This added layer of security reduces the risk of fraudulent activities and enhances customer confidence in making payments.

Leveraging SeerBit virtual accounts for bank transfer payments

SeerBit virtual account is a temporary online account that helps businesses to collect payments by bank transfer and easily reconcile these payments.

The process is straightforward and efficient:

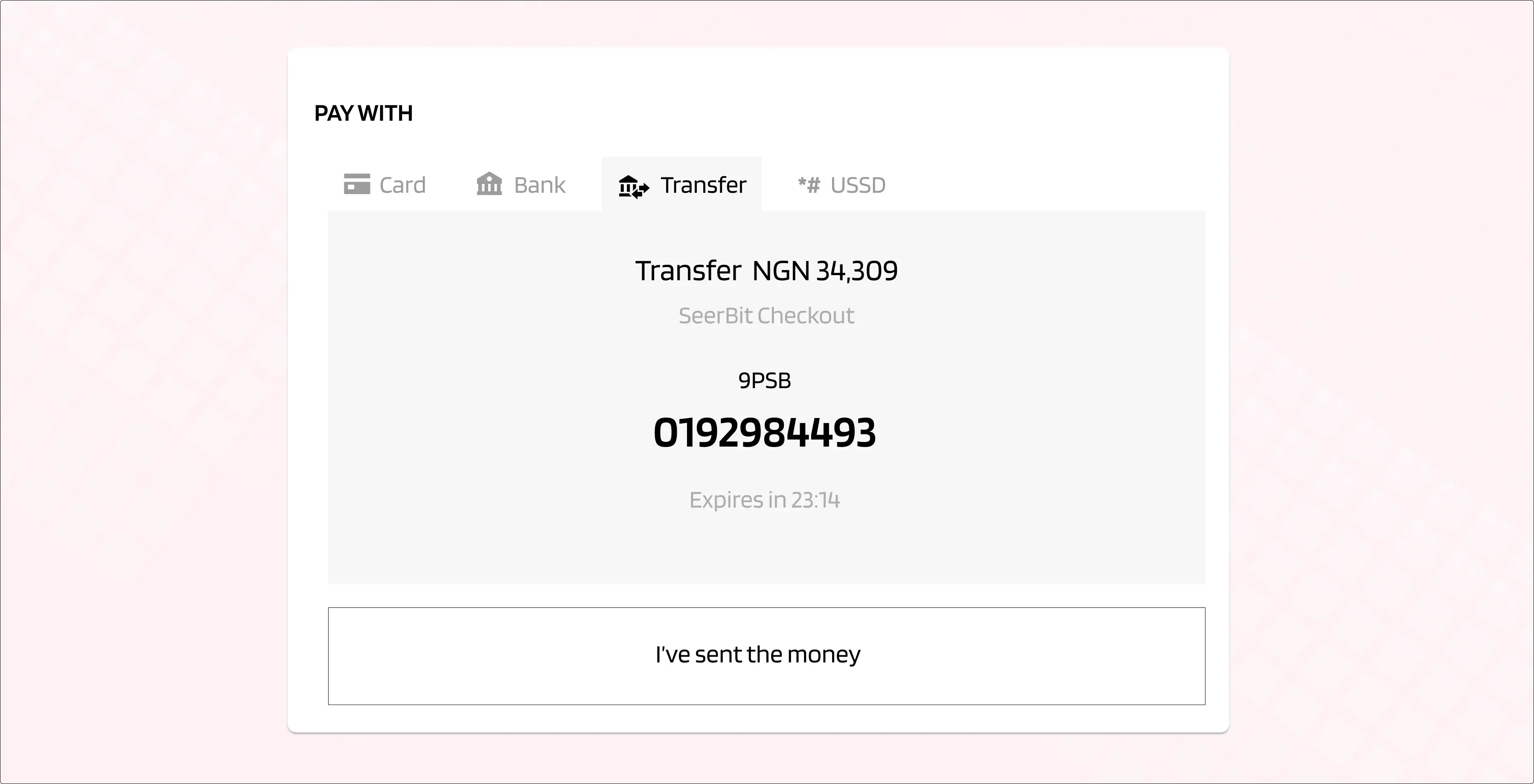

When checking out, the customer chooses the bank transfer payment option.

A unique virtual bank account number is automatically generated for the customer.

The customer copies the account number and proceeds to their bank app to make the transfer.

Upon completion, the customer confirms the payment, and the business receives an instant notification with a unique reference for easy reconciliation.

SeerBit Virtual Accounts offer seamless integration with various payment systems, ensuring a smooth and reliable bank transfer payment experience. The impressive 98% success rate guarantees that businesses can depend on this solution for uninterrupted payment processing.

Benefits of Leveraging SeerBit Virtual Accounts for Businesses

Increased conversion rates

By offering bank transfer payments, you can cater to a broader audience and improve their conversion rates. As a widely accepted payment method in Nigeria, bank transfers open up new possibilities for your businesses to cater to your customers' preferences and drive growth. SeerBit's Virtual account enables businesses to offer bank transfers as a payment option at checkout and even for in-person payments.

Easy reconciliation

For businesses that handle large volumes of transactions daily, reconciling bank transfer payments can be a hassle as it requires a lot of manual effort which can lead to human error in data handling and other inefficiencies.

SeerBit's virtual account simplifies the reconciliation process, providing your businesses with accurate, automated, and up-to-date financial records irrespective of the volume of transactions you are dealing with daily. Saving you valuable time and resources, so you can focus on the core operations of your business.

Detailed Insights into Customer Purchase Patterns

Seerbit's virtual account solution simplifies your finance operations while offering access to comprehensive payment reports and data. This valuable information provides insights into your customers' behavior, enabling you to understand them better and make informed business decisions. With these insights, you can create personalized offerings and effective marketing strategies that enhance customer satisfaction.

Embracing bank transfers as a payment method

Bank transfer payments are a widely accepted payment method in Nigeria, owing largely to its convenience and accessibility. It provides unmatched customer convenience and security which businesses can leverage to increase their customer retention.

There are lots of benefits to accepting bank transfers as a payment method for your business, so you should hop on this train already. But you can enjoy even more benefits such as more conversions, automated payment reconciliation, and data insight by leveraging Seerbit virtual account solution alongside bank transfer payments.

.webp?width=3595&height=1838&name=pay_online%20(1).webp)

.webp?width=3595&height=1838&name=pay_online%20(3).webp)

.webp?width=3595&height=1838&name=pay_online%20(4).webp)