E-commerce Payment Trends for Small Businesses in 2024

Olamide Salami

Jan 10, 2024

The emergence of e-commerce in the past decades has caused a massive shift in how customers shop and pay for products. The outbreak of the covid-19 pandemic and the resultant lockdown accelerated the growth of online shopping, ushering in an era of e-commerce dominance. Even though normalcy has returned, many customers have stuck to habits they picked up during the pandemic. For instance, many people now prefer a digital payment method over the traditional cash method.

As e-commerce continues to grow, payment remains a key component of the ecosystem capable of fast-tracking the growth of an e-commerce business that leverages it. This article discusses some of the latest trends in e-commerce payments that you can leverage for your small business growth.

1. E-wallets

E-wallets, also known as digital wallets, are one of the top rising trends in e-commerce payments this year. It is expected that by 2023 end, more than 4 billion people will have and use e-wallets to make purchases, and 30% of POS payments will happen through e-wallets.

There are several digital wallets, such as Google Pay and Apple Pay that allow customers to make payments seamlessly both online and offline. This is a trend that many retailers and e-commerce stores are on board with, and is only becoming more popular. Hence, the use of digital wallets for payment is a trend that your small business has to keep up with to leverage e-commerce payments.

2. Buy Now, Pay Later (BNPL)

This is another fast-rising trend in ecommerce payments. BNPL, as the name implies, allows customers to buy the products that they need and pay instalmentally. It gives you the power to increase the pool of customers that you serve as you’re able to sell high-value items without eating too deep into your customer’s pockets. So, you get to make more sales and profits as it’s easier to sell high-value items that customers would normally not buy. This provides a convenient payment method for customers to buy what they want, even under tough economic conditions, and you also get to keep your sales and income steady.

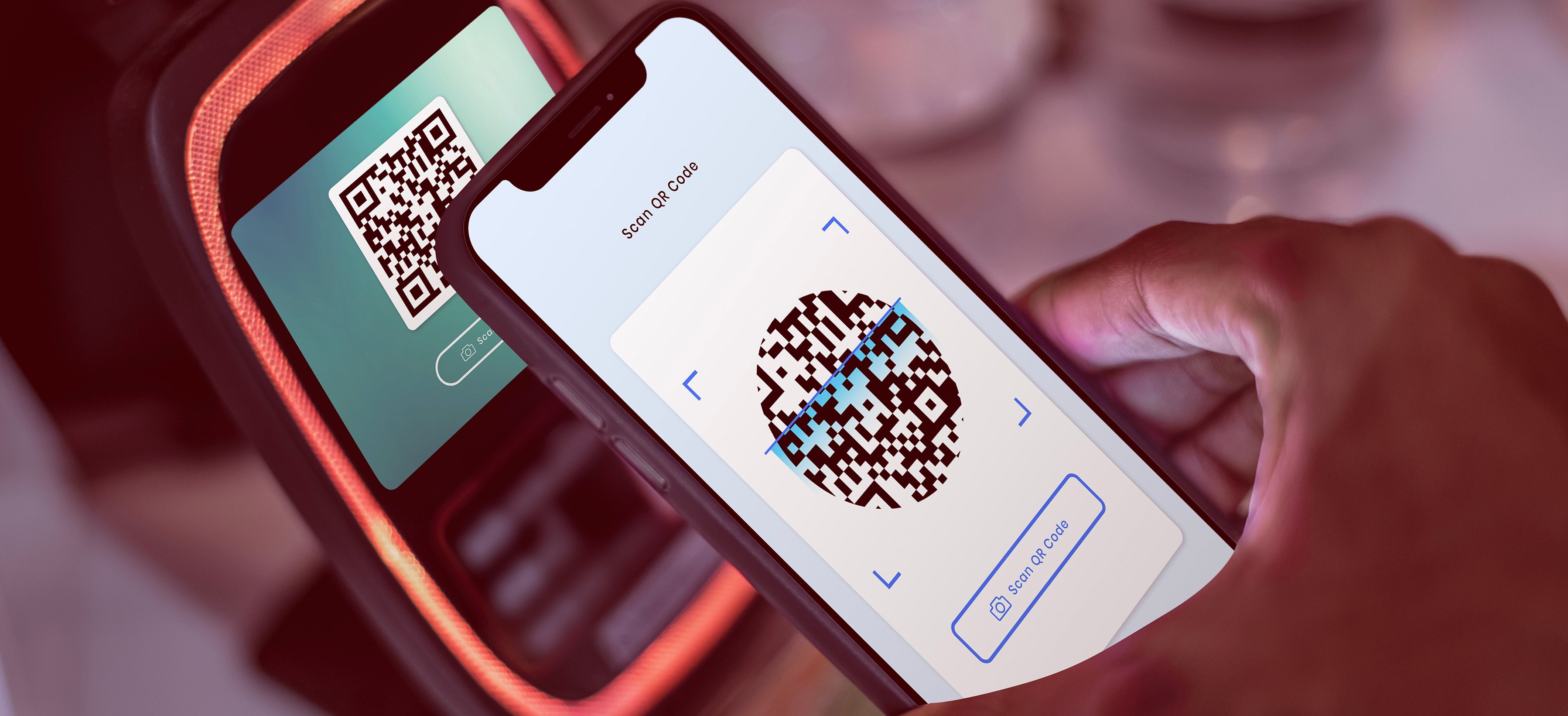

3. Payment Apps

Payment apps offer an easy and convenient way for customers to pay for goods and services, and more people are starting to take advantage of them. These apps use P2P networks, QR codes, or NFC technology so your customers can enjoy a fast, simple, and seamless checkout process. Customers also generally have a preference for using digital apps, so using them to make payments comes with more ease for them. It means they don't need to move around with their cards, and payment is faster for both merchants and customers.

There are several examples of these payment apps that have taken over the e-commerce market, such as Apple Pay, Google Pay, Venmo, etc. These are some of the most common payment apps, and there are other rising apps with incredible features too. You can also use these apps as a tool to acquire and retain your customers as some of them have bonus tracking tools and reward frequent users.

4. Near-Field Communications (NFC)

Near-field communication is a wireless technology over a short range that can be used to pair devices to exchange data and make payments. This is a technology that e-commerce merchants are now adopting for payment. It works similarly to Bluetooth technology but is much faster and very secure. It’s one of the technologies at the forefront of contactless payments for ecommerce retailers and is also used to connect devices easily.

Apart from being a quick and excellent payment method for retailers, you can also use this technology to attract new buyers and inspire loyalty in your current customers. With this technology, you can give your loyal customers points and coupons for their next purchases and also do giveaways, discounts, and other reward programs for your customers in real time. NFC allows you to leverage gamification to increase customer loyalty, entice new customers, and boost sales.

5. Biometric payments

The popularity of biometric payments has continued to rise steadily in the past few years as customers seek an extra level of convenience and security when making payments. By offering biometric payment options, you make it possible for your customers to authorise payments for goods with iris scans, facial recognition, or fingerprints, rather than using PIN codes and passwords. This provides a higher level of security for your customers, since each person has unique biometric information, making it harder for thieves and fraudsters to steal people’s identity and make unauthorised payments.

With this level of verification, customers will feel safer about giving their personal and financial data out online, since they know it can’t be stolen or replicated and are more willing to let go of their hard-earned money. With this technology, you’re able to attract new customers within a shorter time frame because of the high level of security in your checkout process.

6. QR Codes