Embed Financial Services and Scale Your Product Faster with SeerBit

In today's dynamic and fast-paced business world, simply offering products or services without optimizing customer experience may not be enough to ensure sustained growth and success. To remain competitive, businesses must prioritize the ever-evolving preferences of consumers in one key area – payments.

By providing seamless transaction experiences and offering personalized payment solutions, businesses can equip themselves to stay ahead in today's digital landscape. Embedded finance provides a strategic avenue to achieve these goals and gain a competitive edge in the market. In this article, we will explore the importance of embedding financial services for your business, and how SeerBit can help you achieve this and accelerate your product/service growth.

What are Embedded Financial Services?

Embedded financial services refer to the integration of financial services offered by non-financial companies to their customers. This is done by adding the features and services of a white-label payment processor, such as payment processing, fraud prevention, and financial analytics into the product or service of a non-financial business.

The goal of embedding these financial services is to ensure customer convenience, enhance the customer experience, streamline transactions, and drive growth. Consequently, the ability to offer seamless and secure financial services offers your business a competitive advantage in today’s market.

Opportunities in Embedded Finance for Businesses

Buy Now Pay Later (BNPL)

Offering BNPL services allows businesses to attract more customers by providing them with the flexibility to make purchases and pay for them later in installments. This option increases sales and encourages higher-value purchases, boosting revenue for businesses.

Virtual Accounts

Implementing virtual accounts enables businesses to streamline payment processes and offer customers a dedicated account for transactions. This enhances security and provides a seamless payment experience, leading to increased customer satisfaction and loyalty.

Digital Wallets

Integrating digital wallets into businesses' platforms allows customers to store payment information securely and make quick and convenient transactions. Embracing digital wallets enhances customer engagement and fosters a cashless payment environment, which is increasingly preferred by consumers.

Loyalty Programs

Embedded finance enables businesses to develop tailored loyalty programs that reward customers for their repeat engagement and purchases. These programs increase customer retention, encourage brand advocacy, and ultimately drive long-term customer loyalty and profitability.

Benefits of Embedded Financial Services for Businesses

There are several notable benefits to embedding financial services, such as:

Increased revenue opportunities:

Embedded financial services enable your business to monetize products or services in new ways. By integrating payment processing capabilities, you’re able to accept various payment methods, including credit cards, digital wallets, and bank transfers, thereby expanding your customer base and increasing sales. Also, the ease of using embedded payment helps to drive more sales and reduced the likelihood of customers abandoning their carts. This makes it easier to convert your visitors into repeat customers.

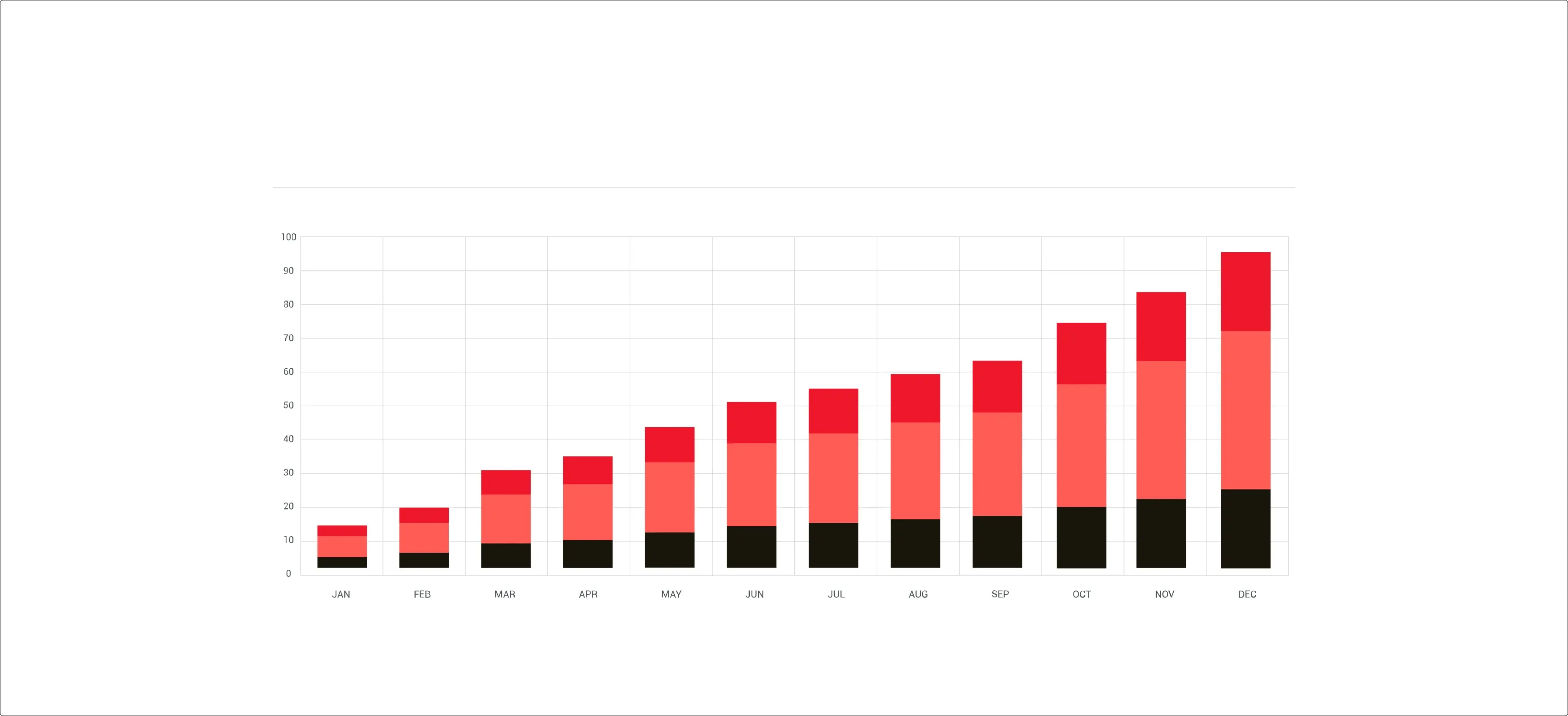

.webp?width=3595&height=1641&name=chart%20(2).webp)

Enhanced customer experience

Leveraging a white-label payment process to embed financial services into your products/services offers a seamless and convenient customer experience. It allows your customers to access financial services and complete transactions without exiting your platform. This gives them a better purchasing experience and increases their satisfaction and loyalty to your brand.

.webp?width=3595&height=1641&name=chart%20(1).webp)

Access to financial insights

These services often come with analytics and reporting capabilities. This means your business would gain valuable insights into customer purchasing behaviour, financial performance, and market trends. These insights empower decision-making and drive growth.

Improved security and fraud prevention

A trusted embedded financial service provider and white-label payment processor, like SeerBit, implement robust security measures and fraud prevention mechanisms. Leveraging these services allows you to protect sensitive customer information, ensure secure transactions, and mitigate the risk of fraudulent activities, enhancing trust and credibility in your business.

.webp?width=3595&height=1641&name=chart%20(3).webp)

Increased Customer Lifetime Value

When businesses integrate financial services into their platforms through embedded finance, they create a seamless and convenient experience for customers. This enhanced user experience not only increases customer satisfaction but also fosters long-term loyalty. As customers find it easier to conduct financial transactions within the same platform where they avail of other services, they are more likely to return and continue engaging with the business over an extended period.

Introducing SeerBit Alpha for Embedded Financial Services

Seerbit white label is a suite of payment processing solutions that you can leverage to offer financial services to your customers in your name. It provides you with a comprehensive suite of financial services, infrastructures, and features that you can leverage for your business and tailor to your unique needs. As a credible white-label payment processor, we offer everything you need to successfully embed financial services into your products or services for rapid growth. This includes payment processing, fraud detection, and prevention, financial analytics, etc.

SeerBit empowers you to scale your products efficiently while maintaining a secure and seamless financial experience for your customers. Leveraging the infrastructure and expertise of a white-label payment processor like ours can expedite your business growth, as you can confidently expand your product offerings.

Advantages of Using SeerBit Alpha

There are several advantages to using SeerBit white label for your embedded financial service. From seamless integration to scalability and time–to–market reduction, there are several ways this white-label payment processor benefits your business.

Seamless integration:

SeerBit offers a user-friendly integration process that allows your business to seamlessly embed financial services into your products or services. The integration is designed to be compatible with various platforms and systems, ensuring a smooth transition without disrupting existing operations. This streamlined integration minimizes the time and effort required from you, enabling you to focus on other critical aspects of product scaling.

Scalability

As your business scales your operations, you would need a white-label payment process that can seamlessly adapt to increasing transaction volumes and customer demands. SeerBit white label is designed to scale alongside your business, offering the flexibility and capacity to handle high transaction volumes effectively. Whether your business experiences rapid growth or seasonal fluctuations, SeerBit white label provides the necessary infrastructure to support scalability without compromising performance or customer experience.

Faster Time-to-market:

Building a robust financial infrastructure from scratch can be time-consuming, delaying product launches or expansions. By leveraging SeerBit white label services, your business can significantly reduce time-to-market. The ready-to-use services, such as payment processing, fraud prevention, and financial analytics, can be swiftly integrated, enabling you to bring your products to the market faster and capitalize on opportunities promptly.

Data analytics and insights:

Understanding customer behaviour, market trends, and financial performance is essential to successfully scale your product. SeerBit white label services include analytics and reporting capabilities that provide your business with valuable data and insights. By leveraging these insights, businesses can make data-driven decisions, optimize their strategies, and identify new growth opportunities, enabling them to scale their products effectively.

Security and compliance:

When it comes to embedded financial services, security, and compliance are of paramount importance. SeerBit understands this and has implemented robust security measures and compliance standards to protect your business and its customers. SeerBit ensures secure transactions, protects sensitive customer information, and provides fraud prevention mechanisms, allowing you to operate confidently in the financial space while meeting regulatory requirements.

Conclusion

Embedding financial services within your product or service is a strategic move to accelerate growth and enhance customer experience. SeerBit, with its comprehensive suite of white-label payment processing services, is a trusted partner for B2B businesses seeking to embed financial services and scale their products faster. By seamlessly integrating SeerBit white label, your business can streamline operations, ensure security and compliance, and unlock new opportunities for revenue growth. Consider SeerBit as your strategic partner in embedding financial services and driving your business forward.

%20(1).webp?width=3595&height=1641&name=embed_financial%20(1)%20(1).webp)

%20(1).webp?width=3595&height=1641&name=chart%20(4)%20(1).webp)

.webp?width=3595&height=1641&name=seerbit_alpha%20(1).webp)