How to Improve Your Cashflow in Business

Olamide Salami

Feb 5, 2024

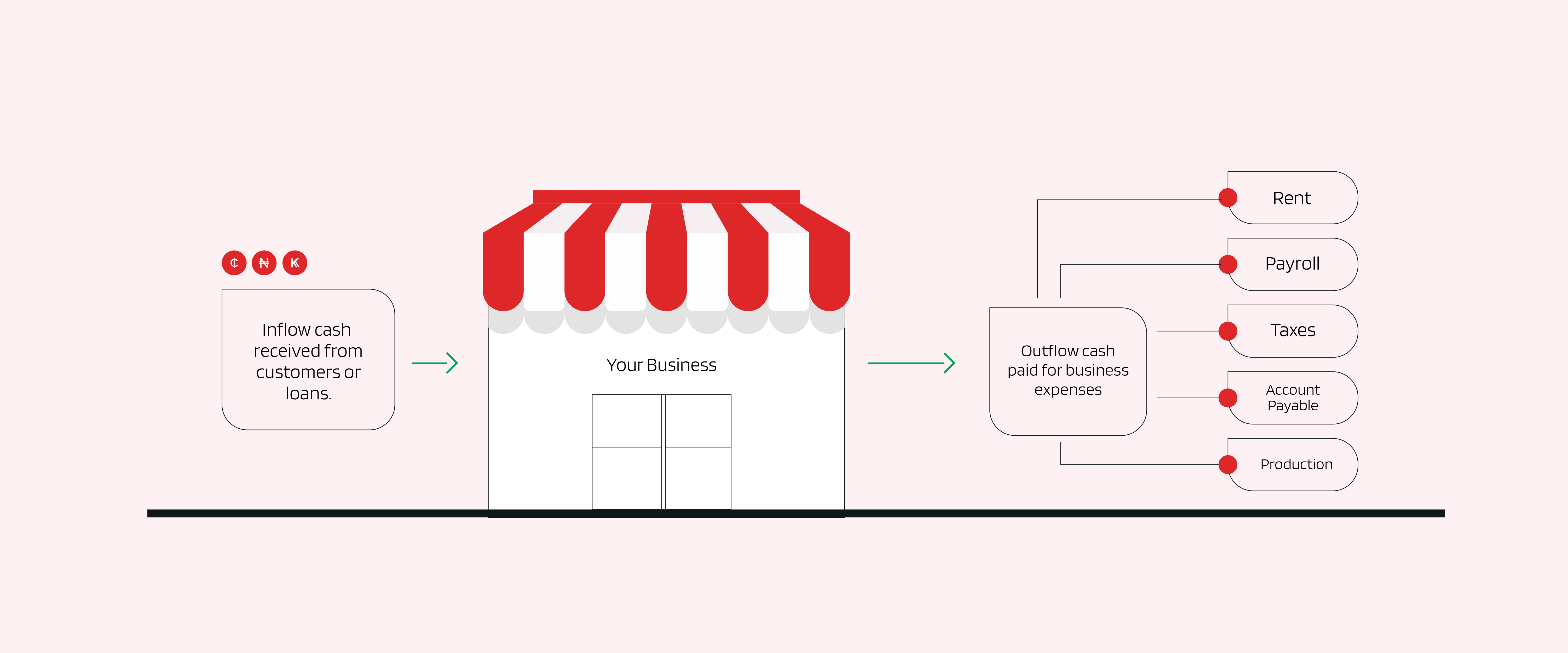

Effective cash flow management is important to run a business venture successfully. An important part of building a business is to know potential business pitfalls and avoid them, as much as you try to maximize every opportunity for growth. Given that lack of cash is the reason why over 80% of businesses fail, you must be able to track your inflow and outflow, and what you have in hand to prevent your business from crashing. Hence, you need to understand cash flow as an important metric to measure the sustainability and predict the profitability of a business.

What is Cash Flow in Business ?