Your Guide To Selling To Millions of Africans As A Global Business

Olamide Salami

Jan 9, 2024

The massive growth potential in the African e-commerce market is currently one of the worst-kept secrets in the world for people seeking to do business in Africa. The growth in African online retail has been ongoing for several years, and the trend is set to continue. This is partly due to several African countries being among the fastest-growing economies in the world. For instance, the GDP of some of the major countries in Africa, such as Nigeria, Egypt, South Africa, Kenya, Ethiopia, and Ghana are $430.92Bn, $425.91Bn, $419.02Bn, $110.35Bn, $99.27Bn, and $79.08Bn respectively. Collectively, the African economy is predicted to hit a GDP of $29 trillion by 2050. This economic indicator points to a large market and a deep pocket that e-commerce businesses can leverage.

It’s also worth noting that Africa has the second largest population in the world and is currently experiencing significant population growth, making it the fastest-growing population center in the world. With the population reaching 1 billion people, most of whom are young people, this means Africa plays a pivotal role in shaping global markets and consumer trends. Consequently, this poses a significant opportunity for businesses seeking to do business in Africa and engage its burgeoning and increasingly affluent consumer base.

Additionally, the rise in internet penetration due to the expansion of smartphones and mobile devices paved the way for the rise of e-commerce platforms in Africa and has reshaped consumer behaviors and market dynamics, especially since the COVID-19 pandemic. This monumental shift has revolutionized the way millions of Africans engage in commerce today. The most notable change is the change in payment behaviors. Since the pandemic, more individuals have moved from the traditional cash-centric payment model towards alternative payment methods, forcing businesses to partner with the best payment processors in Africa to receive digital payments. The prevalence of these alternative payment methods signifies a progressive shift towards more accessible and efficient financial systems and continues to play a significant role in the growth of e-commerce in Africa.

Understanding Consumer Behaviour

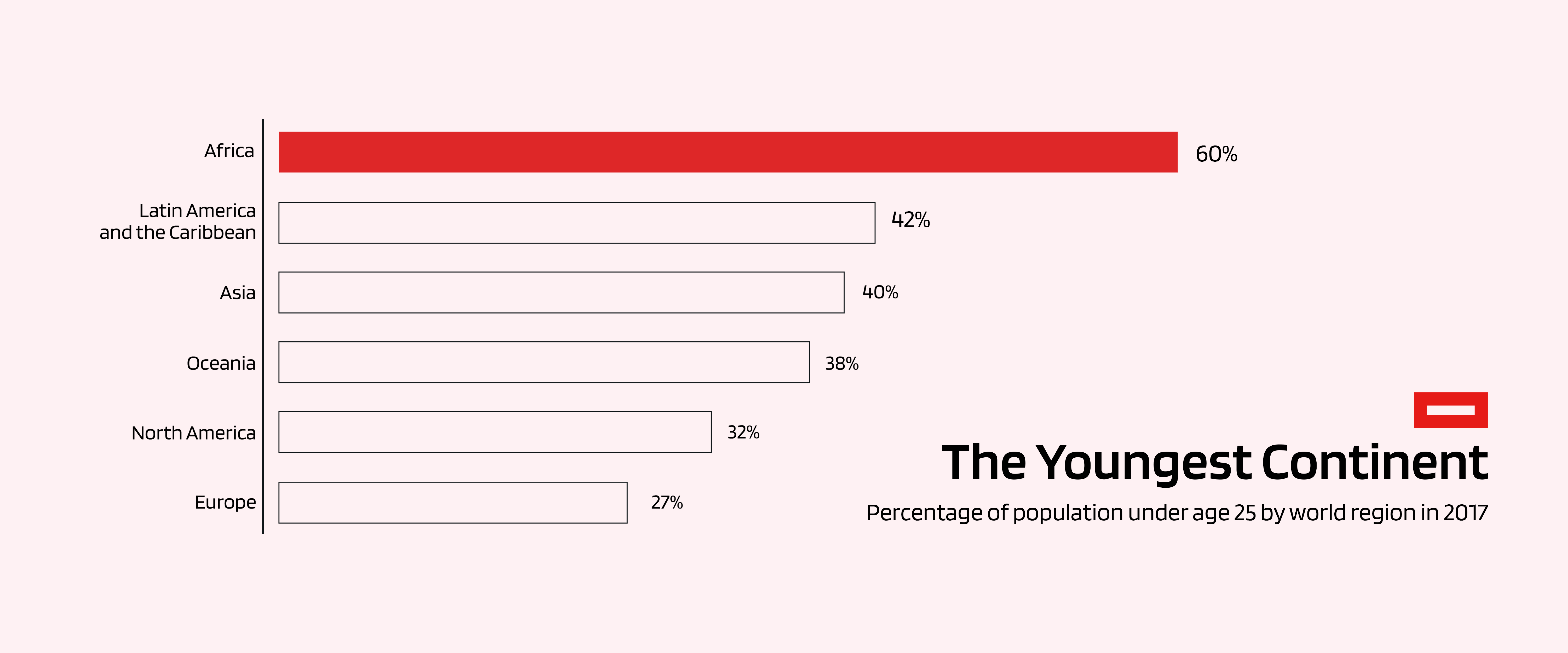

Africa is the youngest continent globally, with approximately 60% of its population being under 25 years old. This vibrant and youthful population plays a vibrant role in determining the growth trajectory of e-commerce within the continent, defining the present and shaping the future of the African e-commerce space. However, beyond their sheer numbers, this generation embodies tech-savviness, digital connections, and a willingness to embrace innovative solutions. The youth’s inclination towards convenience, digital engagement, and exploration of new products and services align perfectly with the dynamics of e-commerce in Africa. As this demographic attains a higher level of disposable income, their influence on consumer spending patterns also rises, positioning them as the major drivers shaping the evolution and direction of e-commerce in Africa.

https://www.gatesnotes.com/Africa-the-Youngest-Continent

For instance, the change in payment behavior in Africa due to the COVID-19 pandemic was spearheaded by its youthful demographic. As the pandemic disrupted traditional modes of transaction and daily life, it accelerated the adoption of alternative payment methods. Platforms like Paga in Nigeria, M-Pesa in Kenya, EcoCash in Zimbabwe, MTN Mobile Money in various countries, and Airtel Money emerged as lifelines for financial transactions providing a secure and efficient means of transferring money and also facilitating online purchases, allowing individuals even in remote areas with limited access to traditional banking infrastructure to participate in eCommerce.

This mass adoption of digital payment methods across the continent propelled a monumental shift in the eCommerce landscape. Hence, businesses with e-commerce websites aiming to capitalize on the digital commerce wave in Africa must tailor their strategies toward this youthful demographic.

Localised Payment Collection

If you’re looking to take advantage of the African e-commerce wave and establish your business in Africa, a crucial part of your expansion success lies in providing a localized payment experience. This is a strategy that international businesses in Africa have had to adopt to thrive in the African ecosystem.

Several challenges hinder consumers in Africa from engaging in cross-border transactions or transactions involving foreign currencies. Hence, their preferences for a more localized and seamless payment experience. Some of these challenges are:

Regulatory Restrictions

Regulatory restrictions pose a significant hurdle for consumers across Africa engaging in cross-border eCommerce. Stringent regulations governing foreign exchange transactions in many African countries often impose limits on the amount of foreign currency individuals can access or necessitate specific documentation for transactions. These limitations and procedural complexities create hurdles for consumers, making cross-border eCommerce cumbersome and restricting their ability to freely participate in international transactions.

2. Limited Availability of Foreign Currency

In several regions across Africa, the scarcity of foreign currency presents a formidable challenge for consumers aiming to engage in cross-border transactions. Economic factors and limited access to foreign exchange reserves contribute to this scarcity, restricting individuals from readily accessing foreign currency for international purchases or transactions. This scarcity not only impedes consumers' ability to engage in cross-border eCommerce but also creates uncertainty and limitations in their purchasing power, and constrains their participation in the e-commerce marketplace.

3. Currency Volatility

Currency volatility in Africa presents a pressing challenge for consumers involved in cross-border transactions. Fluctuations in currency values across the continent, influenced by various economic factors and market dynamics, introduce significant uncertainties for consumers engaging in international purchases. The unpredictable nature of currency fluctuations impacts the cost and value of goods and services, creating concerns for consumers regarding the stability of prices and the real purchasing power of their local currency in international transactions. This volatility often leads consumers to approach cross-border eCommerce with caution, considering the potential risks and uncertainties associated with currency fluctuations.

4. Preference for Seamless, Localized Payment Experiences

Given the challenges associated with foreign exchange, consumers often prefer localized payment experiences that allow them to transact in their local currency. They seek seamless payment solutions that enable them to make purchases without the complexities and uncertainties of dealing with foreign currencies. Accessibility is also an important factor customers consider in their payment experiences. They prefer payment methods that are widely accepted, easy to use, and integrate seamlessly with local eCommerce platforms, avoiding the need for complex currency conversions or foreign exchange processes.

Given the challenges listed above, adapting to local currencies is pivotal for eCommerce companies operating or seeking to operate in Africa. By accepting local currencies, your eCommerce business can mitigate the uncertainty associated with volatility in foreign exchange rates and pricing for international transactions, enhancing transparency and trust among consumers. This aligns your pricing with the currency your consumers are familiar with, eliminating the need for conversions subject to market fluctuations. Moreover, catering to local currencies fosters a sense of inclusivity and convenience, streamlining the purchasing process and reducing friction in transactions. Ultimately, it leads to improved conversion rates by providing a more seamless and predictable shopping experience, positively impacting customer satisfaction and encouraging repeat business.

Payment Methods in Africa

These are some of the most popular payment methods in Africa:

1. Mobile Money

Mobile money has emerged as a transformative financial tool across Africa, revolutionizing the way people manage and transfer funds, pay bills, and conduct transactions through their mobile devices. It's particularly popular in regions with limited access to traditional banking services and has seen significant adoption in countries like Kenya, Tanzania, Uganda, Ghana, and Côte d'Ivoire.

Mobile money provides financial inclusion for the unbanked, allowing them to participate in the economy. In 2019, mobile money transactions in Sub-Saharan Africa totaled $456.3 billion, making up 66% of the $690.1 billion mobile money transactions globally. In 2022, mobile money users in Africa made 44.9 billion transactions across the continent, an increase of more than eight billion transactions from the year 2021.

There are more than 100 mobile money providers in Africa, with M-Pesa and Momo being the two providers with the largest market share. In 2020, M-Pesa alone facilitated over 12.2 billion transactions and generated $784.26 million in revenue.

2. Debit and Credit Cards

Cards have gradually gained traction as a payment method across Africa, especially in more urbanized and economically developed regions. While the popularity of card usage varies by country and region due to infrastructural differences and cultural inclinations, there's a noticeable upward trend in its adoption for online payments.

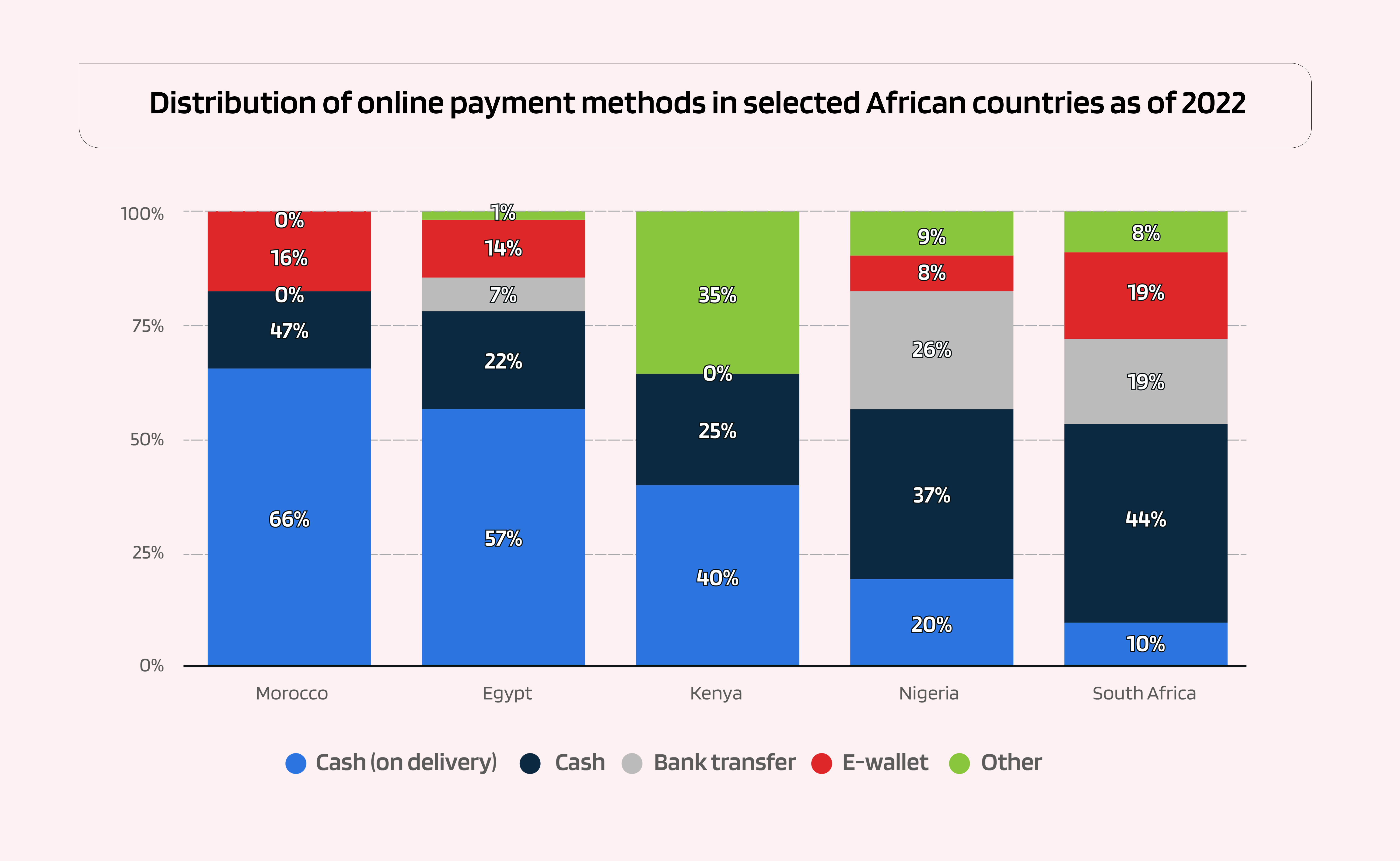

Countries like South Africa, Nigeria, Kenya, Egypt, and Morocco have seen a notable surge in card usage for online transactions. South Africa, with its more established banking infrastructure and higher income levels, stands out as a country where card payments have gained significant traction, particularly in urban areas. According to Statista, as of 2022, 44% of e-commerce payments in South Africa occurred via card, 37% of digital buyers in Nigeria paid by card, and 25% of total online payments in Kenya were done by cards.

3. Bank Transfers

Despite the traditional nature of bank transfers, it remains a significant payment method in Africa. While the prevalence of bank transfers for online payments varies across the continent due to differences in banking infrastructure, regulatory environments, and consumer behaviors, certain regions and countries demonstrate a substantial reliance on this method. For instance, countries like Nigeria, South Africa, Kenya, and Egypt notably use bank transfers for online transactions. Nigeria, with its burgeoning fintech landscape and sizeable population, has 26% of its online payments facilitated through bank transfers, and in South Africa, 19% of e-commerce payments are facilitated via bank transfers.

4. Electronic Funds Transfers (EFTs)

Electronic Fund Transfer (EFT) is another prevalent payment method in Africa for online payments and other financial transactions. This payment method facilitates a direct electronic transfer of funds from one bank account to another and is used for B2B and B2C payments across the continent. The prominence of EFT varies across different countries and regions due to disparities in technological advancements and banking infrastructure. However, in countries like South Africa, Nigeria, Kenya, Egypt, and Ghana, EFT is used substantially for online payments.

Expanding Into Africa With SeerBit

The importance of payment in the success of a merchant operation in Africa cannot be overstated. Providing the right payment method is as important as the goods or services you’re offering in Africa. Hence, you need a payment partner with a wide reach and a comprehensive array of payment methods to facilitate seamless transactions for your operations within the African market. This is what SeerBit helps you achieve.

As a global merchant seeking to expand into Africa, SeerBit provides you with a unified API that affords you easy penetration and access to various African markets. Our API harmonizes the different payment methods across Africa and helps you offer to receive payment for your goods/services in different local currencies

Another important benefit of the SeerBit API for businesses looking to expand into Africa is that it ensures you don’t have to deal with the complexities of registering your business in different African countries and keeping up with the different regulatory frameworks. We do all of that for you and provide you with easy access to the African market. All you only need to do to expand into Africa is sell your product/service through the SeerBit API.

Our centralised dashboard affords you a streamlined operation, so you can track your products, local currency transactions, and cross-border disbursements on the go and in real-time.

Do you want to expand your eCommerce business into Africa? Are you looking to receive payments in local African currencies effortlessly? Do you need a simple API integration with little to no technical requirements? If yes, click here to learn more.